Sample of filling out the title page of the declaration according to the usn. How to correctly fill out a declaration. Basic rules for filling out the declaration

The regulatory authorities have established rules according to which each business entity is required to submit financial statements. A tax return is a document that records the amount of money received by a company during the reporting period. If there is no income, the entrepreneur must submit a “zero” declaration, which indicates the temporary suspension of the company’s activities. If the business is closed, the entrepreneur submits reports for the period of time worked. Below we propose to talk about how to fill out a simplified declaration and consider several important nuances associated with filling out this document.

The tax return form under the simplified tax system, effective in 2018, was approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/99@

Rules for submitting tax reports

In two thousand and sixteen, by Order of the Tax Service, a standard form for filing financial statements was introduced. It is important to note that thanks to the innovations, entrepreneurs have the opportunity to file a tax return electronically. According to the established rules, when choosing a simplified tax payment regime, entrepreneurs submit reports once a year. The deadline for submitting documents is the end of the tax period. It should also be noted that throughout the reporting year, the entrepreneur must make contributions in the form of advance payments. As a rule, such contributions are made every quarter.

As of today, the last day to file a tax return is May 3rd. Each business entity registered as an individual entrepreneur must submit all necessary documents before this date. For legal entities, a different deadline for submitting documents has been established. The last day for reporting is the second of April. Separately, you should consider the situation of filing reports in the event of liquidation of a business. In this case, the documents are submitted to the tax service before the twenty-fifth of the month in which the company was cancelled.

Violation of the above deadline may result in the imposition of penalties from regulatory authorities. If all necessary taxes are paid, the fine will be one thousand rubles. If you fail to pay the simplified tax system, the fine is five percent of the total amount indicated in the tax return. It is important to note that the length of the delay may increase the amount of penalties. Their maximum value can reach thirty percent of the total amount subject to taxation.

Procedure for submitting documents

It should be separately noted that the procedure for filing simplified reports has several specific nuances:

- The managers of individual entrepreneurs submit documents to the tax service offices located at their place of residence.

- Legal entities are required to submit a declaration to the Federal Tax Service office located at the place of registration of the company.

The tax return for the tax paid in connection with the application of the simplified taxation system is the only tax reporting submitted by simplified tax payers

The tax return for the tax paid in connection with the application of the simplified taxation system is the only tax reporting submitted by simplified tax payers In order to find out the address of the required Federal Tax Service branch, you can use the official tax website or the State Services portal. Today, three main methods of submitting documents are available to private entrepreneurs and legal entities. The first method is to provide a paper version of the declaration. To do this, you need to appear at the tax office yourself or entrust this responsibility to a trusted person. In this case, two copies of the declaration are drawn up, one of which is handed over to the tax officer, and on the second a mark indicating the acceptance of documents is recorded.

The copy remaining with the payer is the official evidence of reporting.

The second method is sending a registered letter. In this case, it is necessary to order an inventory of the attached documents, which will confirm the fact that the declaration was sent. A receipt for payment of postal services is considered as a document indicating the date of filing of financial statements. The last method of submitting a package of documents is to use specialized services on the official tax service page or third-party sites.

It should be noted that each of the above methods has its own characteristics. If the declaration is sent via the Internet, the reports must be certified by an electronic signature. When submitting documents through a principal, you must contact a notary office to draw up an official document giving the right to third parties to represent the interests of the principal.

The tax return under the simplified tax system must contain a QR code that reflects all the information available in the reporting. When submitting documentation to the tax office in person, it is recommended to prepare in advance an electronic copy copied to a flash drive. It is important to note that these requirements are not specified in regulations, however, some branches may refuse to accept paper documents.

Filling out a zero declaration

Let's look at an example of filling out a declaration under the simplified tax system “Income” during a temporary suspension of the company’s activities. This method has a number of distinctive nuances. First, you should fill out column “010”, which indicates the place of residence of the owner of the individual entrepreneur or the location of the company. Columns “030” and “060” are filled in only if the company or private entrepreneur has changed its actual address.

Next you should move on to filling out the one hundred and second line. If during the reporting period the individual entrepreneur involved hired workers in its activities, the number “1” is entered. The number “2” indicates the absence of hired personnel. The title page of the document in question is filled out in the standard manner. The same applies to filling out the simplified taxation system “Income minus expenses” declaration. The only difference in this example of filling is the need to fill out the two hundred and sixtieth line of the document.

All simplifiers must report for activities under preferential treatment in 2018 and pay tax at the end of the year

All simplifiers must report for activities under preferential treatment in 2018 and pay tax at the end of the year Procedure for filling out the report

The declaration under the simplified taxation system consists of a title page and three sections. When filling out documents, you should make a note about the amount of advance payments that should have been paid during the reporting period. It is important to note that it is not the amount of taxes paid that is recorded here, but the total amount of quarterly payments. When filling out the “insurance premiums” column, you should indicate the amount of actual payments. According to established rules, penalties are not indicated in this report.

As mentioned above, the document in question consists of several sections provided for business entities using the “Income” and “Income minus expenses” modes.

It should be noted that the procedure for filling out the form differs depending on the selected mode.

The third section of the declaration must be completed only when the company has received certain property assets during the reporting period. The procedure for filling out this section is fixed in the fifth appendix of the instructions for filling out tax reporting. Experts recommend starting filling out the declaration from the second section. All business entities operating in the Russian Federation are required to indicate the amount of income in ruble equivalent.

The standard reporting form contains a table consisting of several cells. When filling out this table, it is recommended to start with the cells located on the left side. If you need to skip cells, you should put a dash. The same actions are performed if it is necessary to specify zero. Separately, it should be noted that each page needs to be numbered. When using the standard template, only completed pages are printed. Submitting blank pages is inappropriate and may result in refusal to accept documents. It is important to note that all dates indicated on the form in question must correspond to the date the document was filled out.

You should also pay attention to certifying the declaration with a seal. It is recommended to place a stamp exclusively on the main page . The use of third party seals not owned by this company is prohibited. In addition, it should be noted that many people filling out this document make a fairly common mistake: fastening the sheets with a binder. This act may also cause refusal to accept the declaration. According to experts, sheets can only be held together with paper clips.

The simplified taxation system (STS) is one of the tax regimes, which implies a special procedure for paying taxes and is aimed at representatives of small and medium-sized businesses

The simplified taxation system (STS) is one of the tax regimes, which implies a special procedure for paying taxes and is aimed at representatives of small and medium-sized businesses Filling out the home page

Instructions for filling out the title page can help the filer avoid the most common mistakes made when filling out the declaration. In the “TIN” column you should indicate the digital value taken from the registration certificate. It is important to note that the length of the TIN of legal entities differs from the code assigned to individual entrepreneurs. Organizations filling out the declaration should put two dashes in the last cells after indicating ten numbers.

Owners of individual entrepreneurs may encounter difficulty filling out the “Checkpoint” section. This code is assigned only to legal entities. Next, go to the “correction number” section. A “0” mark is placed here, indicating that the document has been submitted for the first time. Marks “1” and “2” indicate that edits and additions have been made to this document. After this, you should proceed to filling out the “tax period” section. This field indicates the code corresponding to a specific period. When submitting annual reports, the numbers “34” are recorded. The number “50” indicates that the declaration is being submitted in connection with the cancellation of the business. The mark “95” reflects the transition to another tax payment system.

The declaration form under the simplified tax system contains a section “reporting period”. People filling out this document for the first time often make a mistake in this section. In this column you should indicate the year for which the reports are submitted. If reporting is submitted in two thousand and eighteen, the year 2017 should be entered in this field. After this, you should indicate the code of the tax office itself. You can obtain the necessary information from registration documents or on the website of the inspection itself.

Next, you should proceed to filling out the section “at the place of registration.” Depending on the form of business, filling out this field may vary. Legal entities must enter the number “210”. Individual entrepreneurs indicate the code – “120”. In the “taxpayer” column, entrepreneurs must indicate their first, last and patronymic names, and organizations must indicate the full name of the company corresponding to the registration documents. In the “type of activity” column, OKVED codes corresponding to the chosen direction are indicated. All necessary values can be obtained from the certificate obtained in the unified register of business entities. When filling out this section, it should be taken into account that in two thousand and sixteen new amendments were made to OKVED.

In the event of liquidation or reorganization of a business, the filler should make the appropriate notes in the “reorganization form” section. Next, in the appropriate line, you should indicate the main telephone number of the company. In the field where marks about attached documents are recorded, you should indicate the number of pages in the appendices to the reporting. Typically, a power of attorney is used as an attachment to allow third parties to file financial statements. If there are no applications, a dash is recorded.

The use of the simplified tax system does not exempt you from performing the functions of calculating, withholding and transferring personal income tax from employees’ wages

The use of the simplified tax system does not exempt you from performing the functions of calculating, withholding and transferring personal income tax from employees’ wages The example of filling out the section “power of attorney and completeness of information” deserves special attention. The first line of this section should include the following notes:

- When drawing up a declaration, the owner of an individual entrepreneur or a legal entity personally puts the mark “1”.

- When filling out a report by a proxy, the number “2” is entered.

The owner of the individual entrepreneur must also indicate the date the document was filled out and certify all entered data with his signature. A different procedure has been established for legal entities. In this case, it is necessary to indicate information about the head of the company, and then certify the document with the seal of the organization. In the case where the declaration is drawn up by an authorized person, the data of the authorized person shall be indicated. In addition, you must make a note about attaching the power of attorney, and then certify all the information provided with a personal signature.

In contact with

A declaration under the simplified tax system - income minus expenses is submitted by “simplified” persons at the end of the year or upon completion of business activity. How to fill out a simplified taxation system declaration - income minus expenses, including in the absence of activity, profit or loss, read the material below.

The year-end declaration is submitted by “simplers” in the spring of the year following the reporting one: for legal entities the deadline for submission is March 31, individual entrepreneurs can report no later than April 30.

The material “Reporting and tax period according to the simplified tax system in 2018” will introduce you to the special case of “simplified” definition of a tax period.

The procedure for filling out the simplified tax system declaration - income minus expenses is regulated by order of the Federal Tax Service of the Russian Federation dated February 26, 2016 No. ММВ-7-3/99@.

You can download the USN declaration form “income reduced by expenses” here.

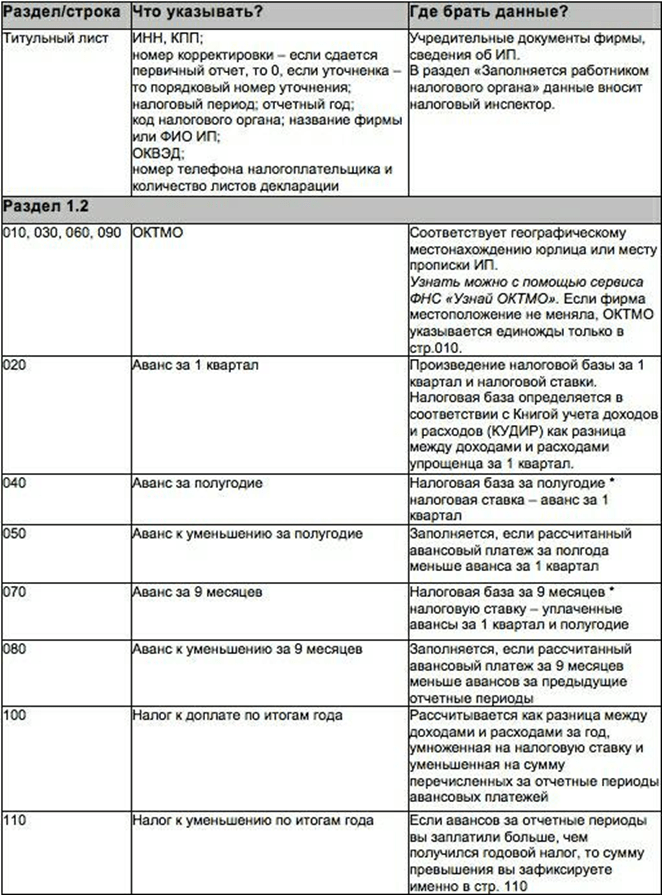

For firms and individual entrepreneurs paying tax on the difference between income and expenses, the simplified taxation system declaration - income minus expenses consists of a title page and sections 1.2 and 2.2. In rare cases, a “simplified” accountant fills out section 3 - it is needed to report on the targeted receipt of money in favor of the taxpayer. For filling details, see the table:

NOTE! There are hints under the names of the declaration lines - control ratios for the accountant. They help to understand how the indicator of each line should be related to the digital values in other lines of the declaration.

A simplified declaration is formed on the basis of data on the receipts and expenditures of the taxpayer’s resources, recorded in the KUDiR of the simplified tax system.

When transferred to the annual report, data from KUDiR is rounded to whole numbers.

Line 120 of the simplified tax system declaration “income minus expenses”

You will find line 120 in section 1.2 of the annual report “simplified” on the “receipts minus costs” system. It is necessary to record in the declaration the amount of the minimum tax under the simplified tax system to be paid for the year. For a taxpayer using the simplified tax system “income minus expenses,” the rule applies: for the year you need to pay tax in the amount of the greater of two amounts:

- the simplified tax itself is the product of the tax rate and the tax base;

- The minimum tax is 1% of the “simplified” income.

Let’s say the taxpayer’s income for 2018 amounted to 12 million rubles. Expenses - 11.5 million rubles. Then the simplified tax, subject to the application of the standard tax rate of 15%, will be:

(12 million - 11.5 million) × 15% = 75,000 rubles.

And the minimum tax is 12 million × 1% = 120,000 rubles.

The minimum tax is greater than the simplified tax, therefore, the company will pay 120,000 rubles for 2018.

If, at the end of the year, the minimum tax payable is obtained, then simplified advance payments transferred for the 1st quarter, half-year and 9 months of the reporting year can be offset against its payment. And in line 120 of the declaration, the taxpayer will show the amount of the minimum tax minus advances paid (clause 5.10 of order No. ММВ-7-3/99@).

You can read more about the procedure for calculating the minimum tax in this material.

USN declaration calculator “income minus expenses”

On our website you can find calculator to calculate simplified tax under the “income minus expenses” system.

It’s easy to use - first, select the period for which you need to calculate the tax amount:

1. If for a quarter, enter the amounts of income and expenses in the appropriate fields and check the tax rate. By default, it is 15%, but beneficiaries (for example, “simplified” workers employed in the production sector) will indicate their value here. The amount of tax to be paid will be the value you are interested in.

In order for the tax amount calculated using the calculator to be reliable, you need to correctly take into account certain incomes and expenses.

The materials in the “Income minus expenses (STS)” section of our website will help you understand this:

- “What income is recognized (accounted for) under the simplified tax system?” ;

- “List of expenses under the simplified tax system “income minus expenses”” ;

- “Accounting for the write-off of goods when applying the simplified tax system” ;

- “Expenses that officials prohibit the “simplified” to take into account”, etc.

2. The annual calculation is filled out in the same way, plus you will need to indicate advances already paid (they can be compared with those calculated automatically) and the amount of loss for previous periods of simplified activities.

When you hover over the question marks next to the names of the calculator fields, you will see hints: what amounts of income and expenses can be taken into account, where to find out about the right to a preferential rate, etc. The calculation results can be saved on the website, printed or sent by email. You can issue the resulting calculation as an accounting certificate, adding the required details from clause 4 of Art. 10 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

An example of filling out a simplified taxation system declaration “income minus expenses” for 2018

An example will help you understand the procedure for filling out a simplified declaration.

Example

Quorum LLC operates in a simplified manner - it helps entrepreneurs and small firms prepare statements of claim, maintain accounting and tax records, submit reports and pay the budget. The receipts and expenses of a legal entity for 2018, as well as data for calculating the simplified tax, are shown in the table below:

|

Reporting period |

Income, rub. |

Expenses, rub. |

|

|

|

|

1st quarter |

|||||

|

half year |

|||||

|

9 months |

|||||

|

1 223 400 |

|||||

|

|

|||||

The accountant of Quorum LLC will fill out the title page in the declaration for 2018, sections 1.2 and 2.2, and will not fill out section 3 due to the lack of facts of receiving targeted funding - see the sample filling for more details.

Zero declaration of the simplified tax system “income minus expenses”

If a “simplified person” did not conduct any activity during the tax period, then the obligation to submit a declaration still remains with him (subclause 4, clause 1, article 23, clause 1, article 80 of the Tax Code of the Russian Federation). In this case, the accountant fills out:

- title page in the usual order;

- in section 1.2 indicates only OKTMO, in the remaining lines - dashes;

- in section 2.2 will record only the tax rate, in the remaining lines - dashes.

Accountants call such a declaration “zero”.

Find out more about zero declarations for various taxes on our website:

- “Sample zero single simplified tax return” .

NOTE! If you forget to pass the zero mark, the fine will be 1000 rubles. according to Article 119 of the Tax Code of the Russian Federation.

Read about the difference between a single simplified declaration and the “zero” declaration of a “simplified” declaration in the material “Unified simplified tax return - sample 2018-2019” .

Declaration of the simplified tax system “income minus expenses”: loss

Entrepreneurship does not always bring profit. If a “simplified” taxpayer had a loss during the reporting period, its size must be documented in the simplified taxation system return. The negative tax base is recorded in line 250-253 of section 2.2, and advances for reduction are recorded in lines 050 and 080. Line 110 is intended for the annual loss. Let us consider in more detail the procedure for filling out a “simplified” declaration with a loss using an example.

Let’s say that the entrepreneurial activity of Quorum LLC in 2018 was carried out with varying degrees of success—at the end of the first half of the year and the tax period, the company had a loss. The receipts and expenses of Quorum LLC for 2018, as well as data for calculating the simplified tax, are shown in the table below:

|

Reporting period |

Income, rub. |

Expenses, rub. |

Taxable base (income minus expenses), rub. |

Tax payable (15% of the taxable base), rub. |

Advance and annual tax payable, rub. |

|

1st quarter |

|||||

|

half year |

Loss 11,690 |

To decrease 21,855 |

|||

|

9 months |

|||||

|

1 123 400 |

1 140 624 |

Loss 17,224 |

|||

|

Minimum tax for the year, rub. |

|||||

NOTE! At the end of the year, the accountant of Quorum LLC will pay 2,577 rubles to the budget. This value is calculated as the difference between the calculated minimum tax and the advances paid (as well as reduced):

11234 - (21,285 - 21285* + 8657) = 2577 rub.

* Advance payment for the half-year reduction was formed due to a loss based on the results of the first 6 months of work in 2018.

If a loss is received in one of the reporting periods of the year, a dash is placed in the corresponding line 270-273. For more details, see the example of filling out the simplified taxation system declaration “income minus expenses” of Quorum LLC.

If you find errors in the submitted declaration that lead to an understatement of tax under the simplified tax system, proceed according to the scheme described in the material.

Results

A “simplified” person fills out a declaration under the income-expenditure simplified tax system on the basis of KUDiR, certificates of advance payments and data on the amount of losses for previous years (if any). If the “simplifier” did not conduct any activity, he must submit a zero declaration, and if he received a loss at the end of the year, then he will have to pay a minimum tax to the budget equal to 1% of income for the year.

Read more about the details for paying advances, annual payments and the minimum tax on the simplified tax system “income minus expenses” .

At the end of the financial year, taxpayers using the simplified tax system

(organizations and individual entrepreneurs) must submit to the tax authorities a declaration on the tax paid in connection with the application of the simplified tax system.

Providing a declaration under the simplified tax system and paying taxes to taxpayers must be carried out in.

Tax return of the simplified tax system Form KND 1152017 (Order of the Federal Tax Service of the Russian Federation of February 26, 2016 N ММВ-7-3/99@) is filled out by taxpayers using the simplified tax system in accordance with the laws of the constituent entities of the Russian Federation in whose territory they are registered. The work must also be guided by the provisions of the Tax Code of the Russian Federation and the data of the organization’s tax registers.

The tax base for tax related to the simplified tax system is:

- The monetary expression of the income of an organization or individual entrepreneur (if the object of taxation is in the form of income).

- The monetary expression of income reduced by the amount of expenses (with the object of taxation being “income minus expenses”).

to menu

DELIVERY methods and FORM for submitting a declaration according to the simplified tax system

The declaration is submitted in the established form: on paper or in established formats in electronic form (transmitted via telecommunication channels).

Note: When transmitting a declaration via telecommunication channels, the day of its submission is considered the date of its dispatch.

In accordance with clause 3, if the average number of employees of the company does not exceed 100 people, the declaration can be submitted not in electronic form, but on paper.

Declaration under the simplified tax system according to Form KND 1152017 on paper is submitted:

- personally;

Note: Passport required

- through your representative;

- sent in the form of a postal item with a description of the attachment.

When sending reports by mail, the day of its submission is considered the date of dispatch.

When sending a declaration by mail, the day of its submission is considered to be the date of sending the postal item with a description of the attachment.

When calculating tax, you must be guided by the law of the subject of the Russian Federation where the taxpayer is registered, because in accordance with clause 2, tax rates are established by the laws of the constituent entities of the Russian Federation and may differ from those specified in.

Take, for example, in accordance with Article 1 of Moscow Law No. 41 of October 07, 2009 “On the establishment of the tax rate... who have chosen income reduced by the amount of expenses as an object of taxation” for organizations and individual entrepreneurs who have chosen As an object of taxation, income reduced by the amount of expenses is set at a tax rate of 10% if they are certain types of economic activity, but the federal value of such a rate is 15%. We see that some regional authorities provide benefits under the simplified tax system.

Based on the types of funds received for the intended purpose, you should select the names and codes corresponding to them (they are given in Appendix No. 5 to the Filling Out Procedure) and transfer them to column 1 of Section 3 (clause 8.1 of the Filling Out Procedure). If there were no receipts, then section 3 is not completed.

Declaration according to the simplified tax system, where to reflect the amount of paid TRADE duty

In addition to the three tax deductions that are provided for all single tax payers, organizations and entrepreneurs engaged in trade can reduce the accrued tax by.

What is needed for this?

1. An organization or entrepreneur must be registered as a trade tax payer. If the payer transfers the trade fee not in accordance with the notification of registration, but at the request of the tax inspectorate, it is prohibited to use the tax deduction.

2. The trade tax must be paid to the budget of the same region to which the single tax is credited. Mainly, this requirement applies to organizations and entrepreneurs who are engaged in trade in places other than where they are registered at their location (place of residence). For example, an entrepreneur who is registered in the Moscow region and trades in Moscow will not be able to reduce the single tax by the amount of the trade tax. After all, the trade tax is credited in full to the budget of Moscow (clause 3 of article 56 of the BC), and the single tax is credited to the budget of the Moscow region (clause 6 of article 346.21 of the Tax Code, clause 2 of article 56 of the BC). Similar clarifications are in the letter of the Ministry of Finance dated July 15, 2015 No. 03-11-09/40621.

3. The trade tax must be paid to the regional budget precisely in the reporting (tax) period for which the single tax is assessed. Trading fee amounts paid at the end of this period can only be deducted in the next period. For example, a trade fee paid in January 2018 based on the results of the fourth quarter of 2017 will reduce the amount of the single tax for 2018. It cannot be taken as a deduction when calculating the single tax for 2017.

- for trading activities in respect of which the organization (entrepreneur) pays a trading fee;

- for the rest of the business.

The actual trade fee paid only reduces the first amount. That is, that part of the single tax that is accrued on income from trading activities. Therefore, if you are engaged in several types of business, it is necessary to ensure that income from activities subject to the trading tax is separately accounted for and income from other activities. This is confirmed by letters from the Ministry of Finance dated December 18, 2015 No. 03-11-09/78212 (sent to the tax inspectorates by letter of the Federal Tax Service dated February 20, 2016 No. SD-4-3/2833) and dated July 23, 2015 No. 03-11-09/42494.

The results of separate accounting are documented in accounting certificates (.docx, 18Kb).

If the single tax on trading activities is less than the amount of the trade fee, the difference cannot be attributed to the reduction of the single tax on income from other types of activities. At the same time, the restriction that does not allow reducing the single tax by more than 50 percent does not apply to the trade tax.

Note: Paragraph 8 and letters of the Ministry of Finance dated 10/07/2015 No. 03-11-03/2/57373, dated 10/02/2015 No. 03-11-11/56492, dated 03/27/2015 No. 03-11-11/16902.

to menu

An example of filling out a simplified tax system INCOME declaration for 2018 with barcodes

Note: Such a declaration is prepared in the TAXPAYER LEGAL ENTITY program, the link is given below

An example of filling out a simplified taxation system declaration INCOME - EXPENSES for 2018

Only completed declaration sheets are submitted to the tax office. Blank sheets don't give up. Why translate the paper? For example, if an enterprise or individual entrepreneur is on the simplified tax system INCOME, only the pages of section 2.1 are filled out, if the simplified tax system D-R is filled out only section 2.2

to menu

PROGRAM and INSTRUCTIONS for filling out the simplified tax system declaration for 2018

The declaration under the simplified tax system consists of five sections and a title page. There are different sections for different taxation objects of the simplified tax system: for the simplified tax system with the object “income” sections 1.1 and 2.1, for the simplified tax system with the object “income minus expenses” sections 1.2 and 2.2. Section 3 and the title page are common to both types of simplified taxation system. Section 3 is presented only to those taxpayers who received targeted financing funds that are not taxed under the simplified tax system. Those. Usually commercial organizations and individual entrepreneurs do not have this section as part of the declaration, so it is not discussed in the article.

Note: The declaration indicates only the accrued tax amounts, the paid amounts are not indicated; the tax office already has data on payments.

to menu

Calculation of the simplified tax system Income 6% in the Excel program Excel for entering into the declaration and paying advance payments

Data is entered quarterly, i.e. revenue for each quarter, how much insurance contributions were actually transferred (and not accrued) in a given quarter to the Pension Fund (pensions and medical insurance), the Federal Social Insurance Fund of the Russian Federation (for benefits and “injuries”), as well as previously paid amounts of advance tax payments.

The table is made conveniently, but it does not take into account individual entrepreneurs without employees! Individual entrepreneurs without employees have no restrictions on tax reduction in accordance with clause 3.1 of Article 346.21.

| ADDITIONAL LINKS on the topic |

- TABLE OF CONFORMITY OF OKTMO and OKATO

What OKTMO code should I write on the payment slip or declaration? 8 or 11 characters? A summary summary table of the correspondence of OKATO codes to OKTMO codes, which was developed by the Ministry of Finance of the Russian Federation, is published. -

We consider in detail the balances and turnovers, for which accounts the Balance Sheet and the Statement of Financial Results for small businesses are compiled (Form KND 0710098).

Exclusive Ekaterina Annenkova, accounting and taxation expert at Clerk.Ru Information Agency

With the end of 2011, the tax period ended and the time has come to draw up a tax return paid in connection with the use of the simplified taxation system (hereinafter referred to as the simplified taxation system).

The tax declaration paid in connection with the application of the simplified tax system is filled out by taxpayers using the simplified taxation system in accordance with Chapter 26.2 of the Tax Code.

Taxpayers submit returns and pay taxes within the following deadlines:

Organizations - no later than March 31, 2012 at their location (registration with the Federal Tax Service).

Individual entrepreneurs (IP) - no later than April 30, 2012 at their place of residence (registration with the Federal Tax Service).

A tax return for taxes associated with the use of the simplified tax system is filled out by taxpayers using the simplified tax system in accordance with Chapter 26.2 of the Tax Code and the laws of the constituent entities of the Russian Federation in whose territory they are registered.

The simplified tax system is a special tax regime with a voluntary procedure for its application by organizations and individual entrepreneurs.

In connection with the application of the simplified tax system, taxpayers are exempt from paying the following taxes:

Organizations:from income tax;

property tax;

personal income tax;

property tax for individuals;

VAT (except for the tax paid in accordance with the simple partnership agreement (joint activity agreement)).

At the choice of the taxpayer, the objects of taxation may be:

- Income (the tax rate is set by the Tax Code of the Russian Federation at 6%);

- Income reduced by the amount of expenses (the tax rate is established by the laws of the constituent entities of the Russian Federation no higher than 15% and no lower than 5% in accordance with clause 2 of Article 346.20 of the Tax Code of the Russian Federation).

The tax base for tax related to the simplified tax system is:

- The monetary expression of the income of an organization or individual entrepreneur (if the object of taxation is in the form of income).

- The monetary expression of income reduced by the amount of expenses (with the object of taxation being “income minus expenses”).

Note: If there is no movement of funds in bank accounts and at the cash desk of the organization, tax payers under the simplified tax system do not have taxable objects (income) to be reflected in the declaration. In this case, the declaration is not submitted, the taxpayer submits a simplified tax return approved by Order of the Ministry of Finance dated July 10, 2007 No. 62n until January 20, 2012.

The declaration is submitted in the prescribed form:

- on paper;

- according to established formats in electronic form (transmitted via telecommunication channels).

When transmitting a declaration via telecommunication channels, the day of its submission is considered the date of its dispatch.

Note: In accordance with paragraph 3 of Art. 80 of the Tax Code, if the average number of employees exceeds 100 people, reporting is provided in electronic form, certified by an electronic digital signature. If the average number of employees of the company does not exceed 100 people, the declaration can be submitted on paper.

When sending a declaration by mail, the day of its submission is considered to be the date of sending the postal item with a description of the attachment.

Note: When calculating tax, you must be guided by the law of the subject of the Russian Federation where the taxpayer is registered, because in accordance with paragraph 2 of Art. 346.20 of the Tax Code of the Russian Federation, tax rates are established by the laws of the constituent entities of the Russian Federation and may differ from those specified in the Tax Code.

In accordance with Art. 346.19 of the Tax Code of the Russian Federation, the tax period is a calendar year. The following are recognized as reporting periods:

- first quarter;

- 6 months;

- 9 months.

The tax return form for tax related to the simplified tax system and the procedure for filling it out were approved by order of the Ministry of Finance of the Russian Federation dated June 22, 2009 No. 58n.

The declaration includes:

- Title page;

- Section 1 “The amount of tax paid in connection with the application of the simplified taxation system and the minimum tax payable to the budget, according to the taxpayer”;

- Section 2 “Calculation of the tax paid in connection with the application of the simplified taxation system and the minimum tax.”

Based on the provisions of the Tax Code of the Russian Federation, the procedure for filling out a tax return for taxes associated with the simplified tax system and the provisions of the Moscow Law of October 7, 2009 No. 41 “On establishing the tax rate for organizations and individual entrepreneurs using a simplified taxation system that have chosen as an object taxation of income reduced by the amount of expenses,” we will draw up a tax return for 2011 for the organization Romashka LLC.

In accordance with Art. 1 of Moscow Law No. 41, for taxpayers who have chosen income reduced by the amount of expenses as an object of taxation, a tax rate of 10% is established if they carry out the following types of economic activities:

1) manufacturing industries (in accordance with Section D "Manufacturing industries" of OKVED);

2) management of the operation of residential and (or) non-residential stock;

3) research and development;

4) provision of social services;

5) activities in the field of sports.

A tax rate of 10% is applied by a taxpayer whose revenue from the sale of goods (work, services) for the above types of economic activity for the reporting (tax) period is at least 75% of the total revenue

1. Title page of the declaration

When filling out the declaration, only one indicator is entered in each line and the corresponding columns. If there are no indicators, a dash is placed in the line and the corresponding column.

TIN, checkpoint- are indicated in accordance with the certificate of registration of the organization, individual entrepreneur, in the Federal Tax Service to which the declaration is submitted.

When indicating the TIN of an organization, which consists of ten characters, in the zone of twelve cells reserved for recording the “TIN” indicator, dashes (- -) should be entered in the last two cells.

Correction number– when submitting a declaration for the reporting period, the number “0--” is indicated for the first time; if corrective declarations are provided, then the adjustment number is indicated in order - “1--”, “2--”, etc.

Tax period (code)– in accordance with Appendix No. 1 to the Procedure for filling out a tax return under the simplified tax system, the following codes correspond to tax periods:

- 34 – Calendar year;

- 50 – Last tax period upon reorganization (liquidation) of an organization (upon termination of activities as an individual entrepreneur).

Reporting year– the reporting year for which the declaration is being submitted is indicated.

Submitted to the tax authority (code)– indicate the code of the Federal Tax Service to which the declaration is submitted, according to the documents on registration with the tax authority. This code consists of four digits. The first two digits are the region code (for example, Moscow - 77, Moscow region - 50), the second two digits are the Federal Tax Service number.

By location (registration) (code)- the code is indicated in accordance with Appendix No. 2 to the Procedure for filling out a tax return. This code means that the declaration is submitted:

Codes for submitting a tax return at the location (accounting)

Taxpayer- the full name of the Russian organization is indicated, corresponding to the name contained in its constituent documents (if there is a Latin transcription in the name, it is also indicated).

In the case of submitting an Individual Entrepreneur Declaration, his last name, first name and patronymic name are indicated in full, without abbreviations, in accordance with the identity document.

Code of type of economic activity according to the OKVED classifier- the code of the type of activity is indicated according to the OKVED classifier.

In the columns " on... pages» - indicates the number of pages on which the Declaration is drawn up.

In the columns " with supporting documents or their copies on... sheets» - indicates the number of sheets of supporting documents or their copies, including copies of documents confirming the authority of the taxpayer’s representative (in the case of signing the Declaration and (or) its submission by the taxpayer’s representative), attached to the Declaration.

In field " I confirm the accuracy and completeness of the information specified in this declaration" - indicates:

- number “1” if the declaration is signed by the head of an organization or individual entrepreneur;

- number “2” if the declaration is signed by a representative of the taxpayer (for example, the chief accountant of a company, individual entrepreneur).

In field " Signature» - the signature of the manager or representative is affixed. The signature is certified by the seal of the organization, individual entrepreneur.

In field " Name of the document confirming the authority of the representative» - indicates the type of document confirming the authority of the signatory (for example, a power of attorney, its number and date).

Note: If the declaration is signed by a representative of the taxpayer, a copy of the document confirming his authority must be provided along with it. The number of sheets of the document must be taken into account when filling out the column “ With the attachment of supporting documents or their copies on ... sheets».

An example of filling out the title page of the declaration:

2. Section 1 of the declaration “The amount of tax paid in connection with the application of the simplified taxation system and the minimum tax payable to the budget, according to the taxpayer”

Section 1 of the declaration contains indicators of the amount of tax under the simplified tax system, subject to the taxpayer’s data:

- payment to the budget;

- to decrease.

In addition, Section 1 states:

- type of taxable object;

- OKATO code;

- budget classification code (BCC) to which the tax is to be credited.

Object of taxation(line 001 ) - the object of taxation is indicated:

- The number “1” is indicated by taxpayers whose object of taxation is income;

- The number “2” is indicated by taxpayers whose object of taxation is income reduced by the amount of expenses (“ income minus expenses»).

OKATO code(line 010 ) - indicate the OKATO code at the location of the organization (at the place of residence of the individual entrepreneur).

When filling out the “OKATO Code” indicator, which is allocated eleven characters, the free characters to the right of the code value, if the OKATO code has less than eleven characters, are filled with zeros. For example, for an eight-digit OKATO code - “12445698”, the eleven-digit value “12445698000” is written in the “OKATO Code” field

Budget classification code(line 020 ) – indicates the digital code of the budget classification by which the amount of tax paid in connection with the application of the simplified tax system is to be credited, based on the following codes:

The amount of advance tax payment calculated for payment for:

First quarter (RUB)(line 030 ) - indicates the amount of the advance payment of tax paid in connection with the application of the simplified tax system, calculated for payment for the first quarter.

At the end of each reporting period, the amount of advance tax payment is calculated:

- 1. object of taxation - income, based on the tax rate and actually received income, calculated on an accrual basis from the beginning of the tax period until the end of the first quarter, half year, nine months, respectively, taking into account previously calculated amounts of advance tax payments. The tax amount can be reduced by the amount of insurance premiums (within the calculated amounts for the same period of time in accordance with the legislation of the Russian Federation):

- § for compulsory pension insurance,

- § compulsory social insurance in case of temporary disability and in connection with maternity,

- § compulsory health insurance,

- § compulsory social insurance against accidents at work and occupational diseases, paid.

- 2. object of taxation “income minus expenses”, based on the tax rate and actually received income, reduced by the amount of expenses calculated on an accrual basis from the beginning of the tax period until the end of the first quarter, half year, nine months, respectively, taking into account previously calculated amounts of advance tax payments .

Half-year (RUB)(line 040 ) - indicates the amount of the advance payment for the tax paid in connection with the application of the simplified tax system, calculated for payment for the six months, taking into account the amount of the advance payment calculated for the first quarter.

Nine months (RUB)(line 050 ) - indicates the amount of the advance payment of tax paid in connection with the application of the simplified tax system, calculated for payment for nine months, taking into account the amount of the advance payment calculated for half a year.

Amount of tax payable for the tax period (RUB)(line 060 ) - indicates the amount of tax paid in connection with the application of the simplified tax system, payable for the tax period, taking into account the amount of the advance payment calculated for nine months.

The value on line 060 is determined:

1. object of taxation - income, by reducing the amount of calculated tax for the tax period by the amount of insurance premiums paid (within the limits of calculated amounts) for this period:

compulsory health insurance;

compulsory social insurance against industrial accidents and occupational diseases.

Also, the amount of tax is reduced by the amounts paid to employees during this period from the taxpayer’s funds for temporary disability and advance payment of tax, calculated for payment for nine months.

Note: This line is filled in if the difference between the indicators for line codes 260, 280 and 050 is greater than or equal to zero.

2. object of taxation “income minus expenses”, as the difference between the values of lines 260 and 050.

Note: This line is filled in if the value for line code 260 is greater than or equal to the indicator for line code 050 and the amount of calculated tax for the tax period is greater than or equal to the amount of calculated minimum tax.

Amount of tax to be reduced for the tax period (RUB)(line 070 ) – indicates the amount of tax paid in connection with the application of the simplified tax system to be reduced for the tax period.

The value on line 070 is determined:

1. object of taxation - income, as the difference between the values of line 050 and line 260, minus the value of line code 280.

Note: This line is filled in if the differences between the indicators for line codes 260, 280 and 050 are less than zero.

2. object of taxation " income minus expenses", as the difference between the values of lines 050 and 260, if the value on line 050 is greater than the value on line 260 and the value on line 270 is less than or equal to the value on line 260, or as the value on line 050, if the value on line 260 is less than the value on line 270 .

Budget classification code(line 080 ) – indicate the digital code of the budget classification “18210501050011000110” (Minimum tax credited to the budgets of the constituent entities of the Russian Federation) according to which the amount of the minimum tax paid in connection with the application of the simplified tax system is subject to credit.

The amount of minimum tax payable for the tax period(line 090 ) – indicates the amount of the minimum tax payable for the tax period.

The value on line 070 in this case corresponds to the value of the indicator on line 270.

Note: This line is filled in if the value on line 270 is greater than the value on line 260.

1. Section 2 of the declaration “Calculation of the tax paid in connection with the application of the simplified taxation system and the minimum tax.”

Section 2 of the declaration contains the taxpayer’s data on the tax rate paid in connection with the use of the simplified tax system; in addition, Section 2 indicates:

- The amount of income received;

- The amount of expenses incurred (if the object of taxation is “income minus expenses”);

- The tax base;

- Amount of tax accrued;

- Amount of losses from previous years;

- Amount of losses for the current year;

- Minimum tax amount.

Tax rate (%) (line 201) – the tax rate is indicated in the amount of: st. 346.16 of the Tax Code of the Russian Federation, with the object of taxation “income minus expenses”.

Taxpayers have the right to include in expenses the amount of the difference between the amount of the minimum tax paid and the amount of tax calculated in the general manner, received for the previous period.

Note:

The amount of loss received in the previous (previous) tax period(s), reducing the tax base for the tax period for line 001 = “2” (line 230) – indicates the amount of loss received in the previous (previous) tax period(s) ) period (periods), reducing the tax base for the tax period, with the object of taxation being “income minus expenses”.

Note: If the object of taxation is income, this line is not filled in.

Tax base for calculating tax for the tax period for line 001 = "1": equal to line 210, for line 001 = "2": line 210 - line 220 - line 230, if line 210 - line 220 - page 230 > 0 (line 240) – indicates the tax base for calculating tax for the tax period.

1. If the object of taxation is income, line 240 = line 210.

2. If the object of taxation is “income minus expenses”, line 240 = (line 210 - line 220 - line 230). Line 240 is filled in if the received amount is greater than zero.

The amount of loss received for the tax period for line 001 = “2”: line 220 - line 210, if line 210

Line 250 = (line 220 - line 210) is completed if the amount of income received indicated in line 210 is less than the amount of expenses incurred reflected in line 220.

Note: If the object of taxation is income, this line is not filled in.

Amount of calculated tax for the tax period (page 240 * page 201 / 100) (line 260) – indicates the amount of tax calculated based on the tax rate and tax base, determined on an accrual basis from the beginning of the tax period to its end.

Tax amount (line 260) = Tax base (line 240) * Tax rate (line 201) / 100.

The amount of the calculated minimum tax for the tax period (tax rate 1%) for line 001 = “2”: line 210 * 1 / 100 (line 270) – indicates the amount of the minimum tax calculated for the tax period, with the object of taxation “income minus expenses” "

Amount of minimum tax (line 270) = Amount of income received (line 210) * 1/100.

If for the tax period there is no value on line 260 (a dash is inserted) or the specified value is less than the value specified on line 270, then the value on line 270 must be reflected in line 090 “The amount of the minimum tax payable for the tax period” of Section 1 .

Note: If the object of taxation is income, this line is not filled in.

The amount of insurance contributions paid during the tax period for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases, as well as paid to employees during the tax period from funds of the taxpayer for temporary disability benefits, which reduces (but not more than 50%) the amount of calculated tax for line 001 = “1” (line 280) - indicates the amount of benefits paid (within the limits of the calculated amounts) for the tax period from taxpayers’ funds for benefits temporary disability and amount of insurance premiums:

- for compulsory pension insurance;

- compulsory social insurance in case of temporary disability and in connection with maternity;

- compulsory health insurance, compulsory social insurance against accidents at work and occupational diseases.

These amounts reduce (but not more than 50 percent) the amount of calculated tax for the object of taxation of income.

Note: If the object of taxation is “income minus expenses”, this line is not filled in.

- Where can I download the current USN tax return form (according to KND form 1152017)?

- Tax return filing deadlines

- An example of filling out the KND form 1152017

- What programs and services will help you fill out the declaration?

It is not difficult to prepare a tax return for an individual entrepreneur using the simplified tax system - you can use the free official program from the Federal Tax Service of the Russian Federation "Taxpayer Legal Entity", the paid program "1C: Entrepreneur", or order filling out the declaration from a specialized accounting company.

If you want to fill out the declaration manually, download the current form according to the KND 1152017 form in PDF format.

Example of filling out a tax return

The example shows a declaration for an individual entrepreneur without employees on a simplified taxation system with a tax rate of 6% (income) who does not pay trade fees, who did not change the place of registration (registration) during the reporting year. If you need other filling options, you can also use the most detailed official instructions.

When filling with a ballpoint pen, you can only use black, purple or blue ink. When printing on a printer, you need to use the Courier New font with a height of 16-18 points. You can only print on one side of the page (double-sided printing is not allowed). Filling is done only in capital letters.

For this example, you need to fill out three pages of the declaration:

- Title page

- Section 1.1

- Section 2.1.1

First page (Title page)(see example of filling)

- Fill in your TIN

- Correction number - 0 (if you are submitting a declaration, and not corrections to it)

- Tax period code - 34 (this means that the declaration is submitted for the year)

- Reporting year - the year for which you are reporting

- Tax authority code - the four-digit code of your tax office (can be found in the notice of registration of an individual with the tax authority, which was given to you when registering an individual entrepreneur with the tax office, or)

- Code by location - code 120 means at the place of registration of the individual entrepreneur

- Fill in your full name

- Code of the type of economic activity according to the OKVED classifier - write your main OKVED code (you can find it in the extract from the Unified State Register of Individual Entrepreneurs, which you received when registering an individual entrepreneur with the tax office)

- It is necessary to indicate the code according to the new OKVED (OK 029-2014 (NACE Rev. 2)). The tax office automatically converted the old codes to new ones. If you do not know your new OKVED codes, you can find them out using the service (electronic statement about yourself).

- Write your contact phone number

- Write how many pages there are in your tax return according to the simplified tax system (usually there are 3)

- If you submit the declaration yourself (and not with the help of a representative), put 1 in the taxpayer/taxpayer representative field

Second page (Section 1.1)(see example of filling)

- Write your TIN

- Enter the page number

- In line 010, enter your OKTMO code. If it has not changed during the reporting period, it is enough to indicate it only in line 010. You can find out the OKTMO code in the notification from Rosstat, which was given to you when registering an individual entrepreneur (if it has not changed since then) either in the FIAS system, or using official Rosstat.

- In lines 020, 040, 070, 100 you need to insert the values calculated using the appropriate formulas. To calculate them, you must first fill out the third page of the declaration. Return to this point after completing the third page.

- After filling out the third page, count the line 020 : line 130 minus line 140. Line 040 is equal to: line 131 minus line 141 minus line 020. Line 070 is equal to: line 132 minus line 142 minus line 020 minus line 040. And finally, line 100 is equal to: line 133 minus line 143 minus line 020 minus line 040 minus line 070. These calculations are given only for this specific example, the exact calculation formulas are indicated directly in the declaration form under the corresponding lines.

Third page (Section 2.1.1)(see example of filling)

- Write your TIN

- Enter the page number

- Indicate the taxpayer's characteristics (if you do not make payments to individuals - 2)

- In lines 110, 111, 112, 113, indicate your income cumulative total. You must indicate the amounts specifically for the first quarter, half a year, nine months and a year, i.e. in line 110 - income for the first quarter, in line 111 - the amount of income for the first and second quarters, in line 112 - the amount for the first, second and third quarters, in line 113 - the amount for the first, second, third and fourth quarters.

- In lines 120-123 - the simplified tax system “income” tax rate in force in your region (usually 6%).

- In lines 130, 131, 132, 133 - you need to write the corresponding amounts of calculated tax. For example, line 130 will be equal to: line 110 multiplied by line 120 and divided by 100 (i.e., take, for example, 6% of income for the first quarter).

- In lines 140, 141, 142, 143 - you need to write cumulative total corresponding amounts that reduce your tax simplified tax system (insurance premiums that you paid for yourself)

- These amounts are indicated in the quarter in which they were actually paid.

- These are not the amounts of contributions paid themselves, but the amounts of contributions paid reducing Your tax. That is, for example, as indicated directly in the declaration form: line 140 can be less than or equal to line 130 (for taxpayer attribute = 2 - not making payments to individuals), but cannot be greater than it!

Make sure that the dates and your signature are included wherever required, and before submitting, show the tax return to your tax inspector so that he can check it. Don't forget to stamp it (if you use it).

How to submit a tax return to the simplified tax system?

A tax return can be submitted:

- personally;

- by mail (with a description of the attachment);

- via telecommunication channels (via the Internet).

Individual entrepreneurs must submit a tax return to the tax authority at their place of registration. You will have to pay fines for violating the filing deadlines, so it is better not to delay. When submitting a tax return in person, make two copies - one will remain with the tax office, and the other, with a mark of delivery, will be given to you - it is mandatory save this copy. If an entrepreneur submits a tax return by mail (with a list of attachments), the post office will issue a receipt with a date - this date will be considered the date of filing the return. In the case when an individual entrepreneur simultaneously operates under several taxation systems (for example, simplified tax system + UTII), it is necessary to submit separate declarations for both the simplified tax system and UTII.

Deadlines for submitting a tax return for individual entrepreneurs using the simplified tax system

The tax return for individual entrepreneurs on the simplified taxation system (simplified taxation system) in 2018-2019 is filled out and submitted once a year (i.e. you do not need to fill out and submit a return every quarter) by April 30 of the year following the expired tax period .

- Pearl barley porridge with beef

- Recipes for baked apples with cottage cheese, raisins, honey, nuts and cinnamon

- You can get better from potatoes

- Puff pastries stuffed with stewed cabbage

- Recipe: Sponge cake "Apple" - "in the oven"

- Chicken hearts in sour cream sauce

- How to cook bacon and eggs

- How to cook minced meat with vegetables in a hurry

- Gemini - their compatibility with other signs in love

- Submitting an application for the Unified State Exam: deadlines and features of the procedure

- Meaning of the female name hope

- How to reduce VAT and maintain profits

- International accounting and reporting standards

- How to fill out a tax return correctly

- Crab salad with cheese - five best recipes

- Cutlets in foil in the oven

- Salad of crab sticks with corn, cheese and egg Crab salad with hard cheese

- Potatoes with minced meat in the oven in foil

- Cutlets in foil in the oven

- Minced meat in foil in the oven with filling